- Why Insurance is Important?

- Student Health Insurance Literacy

- Comparing Plans

- Key Considerations

- Anthem Student Advantage

- Other Alternatives

Why Insurance is Important?

Health insurance is an essential resource for all students. Unexpected health care expenses such as those associated with unexpected illness, accidents, or mental health can destabilize a student’s financial situation and derail their progress toward a degree. These potential barriers to attendance and degree completion are reduced when students have health insurance.

Missouri S&T encourages all domestic students to carry adequate health insurance coverage. We offer an optional plan designed specifically for S&T students called Anthem Student Advantage.

Missouri S&T requires all international students for whom student visa documents are issued by the University to be enrolled in Anthem Student Advantage insurance. International students enrolled in academic coursework will be automatically enrolled in the plan. Review additional details.

Student Health Insurance Literacy

Health insurance has a language of its own and can be challenging to understand and navigate. Below are some commonly used terminology.

Health insurance helps to cover some or all of the costs attributed to your medical care are covered in exchange for a regular rate, known as a premium (HealthCare.gov, 2021).

Premium is the total fee that you pay for your health care services in monthly bills, even if you do not go to a health care professional or receive medical care (HealthCare.gov, 2021).

Deductibles the annual amount you must pay before your insurance plan begins to pay for medical services.

Co-pay is the payment that you make at the time of visit with your health care provider(after yearly deductible has been met).

Co-insurance is set percentage you pay each time you use your policy for doctor visits, hospital visits or prescription drugs (after yearly deductible has been met).

Out-of-pocket costs are the fees that you must pay for medical care that will not be paid by the insurance policy.

In-Network is an approved medical provider or service covered by your insurance provider

Out-of-Network is not an approved provider or service under your plan and may not be covered.

Prior Authorization is required for some procedures and elective surgeries that require approval through your insurance before receiving care.

Explanation of Benefits (EOB) is a document that comes after medical services have been provided that is not a bill but acknowledges what your plan has covered for you and if there are additional fees that will be assessed at a later date.

Comparing Plans

When Comparing Student Health Insurance Plans, Consider the Plan Type

PPO (Preferred Provider Organization) – Allows for a network of participating provider healthcare professionals through hospitals and individual doctors. You can see doctors and providers outside your network however, this will increase out of pocket costs.

EPO (Exclusive Provider Organization) – Limits to specific providers in network and will not pay out-of-network expect for emergency services.

POS (Point of Service) – Lower payments for use of in-network providers but requires primacy care providers to make referrals for specialists.

HMO (Health Maintenance Organization) – Often limited to contracted HMO doctors, will likely not cover out of network providers with the exception of emergency care. Potentially restricted to those who live or work in area specific to the plan.

Most insurance plans have a minimum standard of care clause meaning that a set number of preventative visits may also be included in your care.

(HealthCare.gov, 2021)

Key Considerations

Choosing an insurance plan is not an easy undertaking. To help you decide what is best for you, here are some helpful considerations for your decision-making process.

Things to consider when using an existing health insurance plan at college.

- Are there in-network provider options on or near campus?

- Are you covered at home, campus, in any state, any country, and year-round?

- How high is the deductible and out-of-pocket costs?

- Does the policy offer prescription drug coverage?

- Will you be able to obtain the care needed with your plan?

- Does the policy include coverage for both emergency and non-emergency services?

10 Essential Benefits of Adequate Care

- Laboratory Services

- Emergency Services

- Prescription Drugs

- Mental Health and Substance Use Disorder Services

- Maternity and Newborn Care

- Pediatric services, including oral & vision care

- Rehabilitative and Habilitative Services & Devices

- Ambulatory Patient Services

- Preventative, Wellness Services, and Chronic Disease Management

- Hospitalization

Additional Benefits to Consider

- Dental Coverage

- Vision Coverage

- Birth Control Coverage

- Breastfeeding Coverage

- Medical management programs (for specific needs like weight management, back pain, and diabetes)

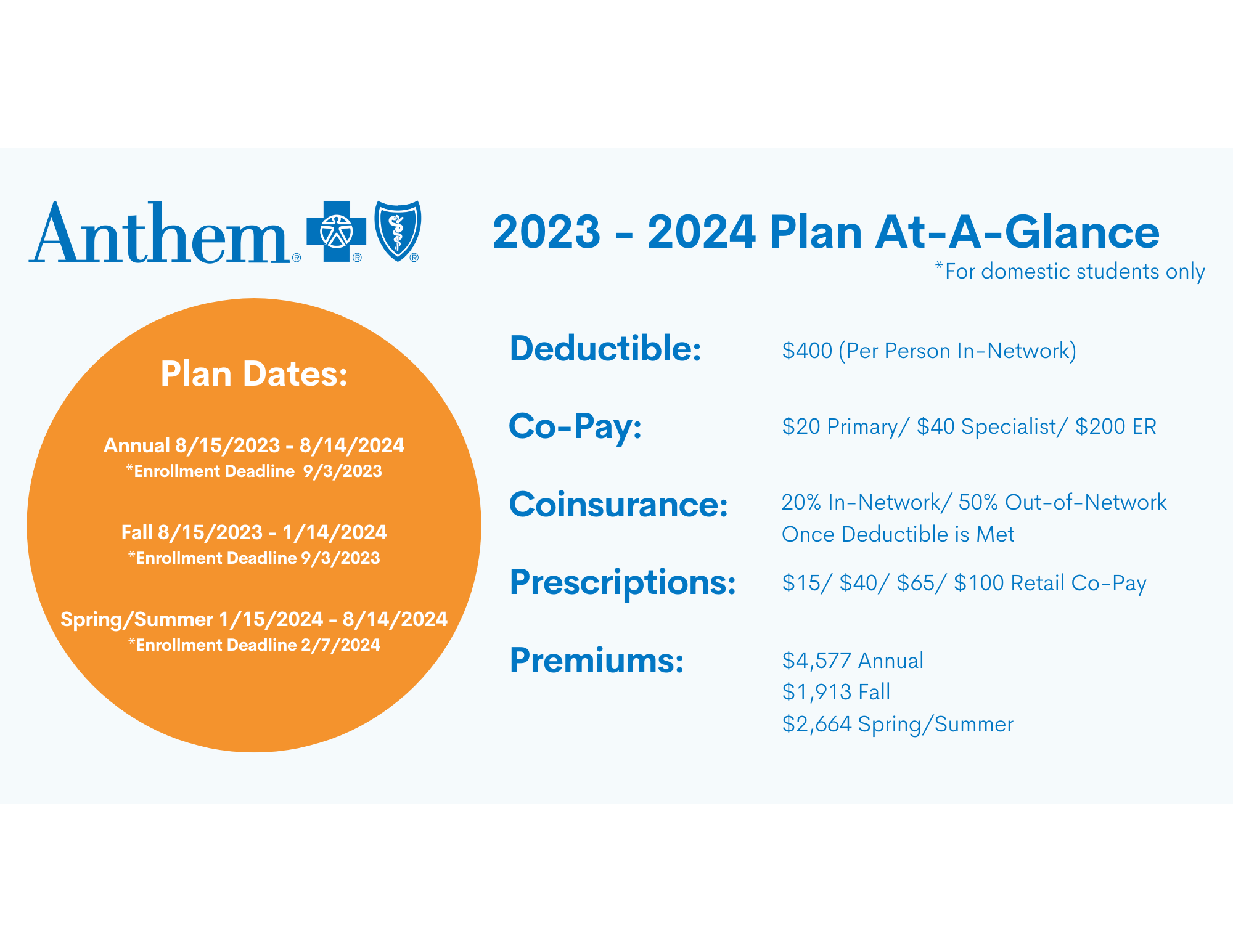

Anthem Student Advantage

A health plan designed specifically for college students. Get student-minded, school-friendly, access-focused care through the S&T Anthem Student Advantage plan.

Below are a few resources available to S&T students through Anthem Student Advantage.

- LiveHealth Online – Available to all students – online app access to Doctors, Psychiatrists, Psychologist and Therapists 24/7.

- Live, on-demand video visits via smartphone, tablet, or computer. Check out the LiveHealth Online brochure.

- Costs the same as the office visit copay–or less, if enrolled in the student plan, otherwise standard rates apply.

- E-prescribing to the pharmacy of choice.

- No additional cost for students enrolled in Anthem Student Advantage

- Students not enrolled in the Anthem Student Advantage may also access a provider by using their own insurance or self-pay.

- NurseLine – Available to all students – at no additional cost

- Staffed 24/7 by registered nurses accessible by phone.

- Get answers to general health questions and minor health concerns

- This fall students may add 1-844-545-1429 to their contacts to get health questions answered at their fingertips

- Sydney Health App – free online and mobile program to access their plan info, benefits, and other health related resource

- Designed for students enrolled in Anthem Student Advantage

- Get access to benefits, insurance information, and resources

- Connect to a LiveHealth provider directly through the app

- myStrength – freemobile app designed to support emotional health

- Designed for students enrolled in Anthem Student Advantage

- Directly accessible through the Sydney Health app

- Provides wellbeing and behavioral health tools to students

- GeoBlue – health insurance coverage when traveling abroad for students enrolled in Anthem Student Advantage

Other Alternatives

Still not sure what options are right for you? Here are some alternatives to receive insurance and/or healthcare.

Medicaid

There are three covered populations in the state of Missouri: adults with development or physical disabilities, pregnant women, and children. https://www.medicaid.gov

Affordable Care Act Marketplace Insurance

Accessible at healthcare.gov. Can enroll during designated enrollment period or if there is a critical life event that causes loss of coverage; there is a 90-day window to apply. Eligibility is based on income and family size. https://www.healthcare.gov/glossary/affordable-care-act

Federally Qualified Health Centers (FQHC)

Places that are federally qualified to provide services on a sliding scale. In Rolla, Four Rivers Community Health Center is an FQHC that may provide some services on a sliding scale fee based on your income and family size.

Public Health Departments

Some public health departments can provide basic services for a minimal fee. Check your local public health department or ask Student Health Services for more information. Visit Phelps-Maries County Health Department.

Urgent Care or Pharmacy Clinics

Based on your location you may be able to go to urgent care clinics or ones in pharmacy’s like CVS and Walgreens. These services may or may not be covered by your insurance; consult your plan to be sure. If you are experiencing an emergency, please go directly to an emergency care provider NOT urgent care or minute clinics.

- Local Emergency Care

- Phelps Health Emergency Medicine, 1000 West 10th Street, Rolla

- Local Urgent Care

- Phelps Health Immediate Care Rolla, 603 South Bishop Avenue, Rolla

- Mercy Convenient Care, 1605 Martin Springs Drive, Suite 210, Rolla

- Rolla Family Clinic, LLC, 1060C South Bishop Ave, Rolla

Anthem Student Health Advantage

More Information on Anthem Student Health Advantage

Follow Student Affairs